Preparing and managing university budgets and forecasts is a specialised, strategic task, and is often the responsibility of a skilled central strategic planning office. However, success is largely driven by strong links to the strategic plan and widespread institutional engagement in the budgeting and forecasting process.

A recent Budgeting and Forecasting study conducted by Cubane in the Australia and New Zealand (ANZ) region found that many universities still seek to understand how to best utilise budgeting as an effective tool to implement the university’s strategic plan and drive accountability. While participant universities have defined their budget performance targets and margins to varying degrees, the real challenge is in building stakeholder buy-in and understanding of the budgeting principles and process.

In our study, we discussed four key approaches to address this challenge.

Building strong foundations for collaboration

Within the ANZ group, there was no ‘one-size-fits-all’ delivery model for budgeting and forecasting. Our study found that Australian and New Zealand universities are making a range of choices around the degree of centralisation, workforce structure and other key elements of the service delivery model.

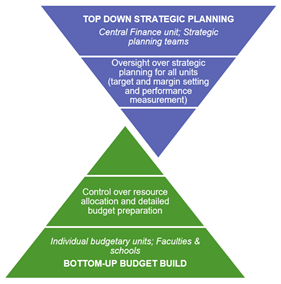

Regardless of the core model employed by universities, our research found that the organisations who are achieving higher levels of stakeholder buy-in are those that follow a ‘top-down’ ‘bottom-up’ budgeting approach, where responsibilities are allocated strategically between the central budgeting team and individual units. Often, this model sees Central Finance units in charge of setting key performance targets, while individual budgetary units such as faculties and schools have control over resource allocation and detailed budget preparation for their unit.

This approach aligns budgeting with the strategic planning function of the university while still fostering a sense of ownership, autonomy and buy-in at the unit level. When implemented correctly, it can be successful at enabling ‘big picture’ thinking that reinforces the link between strategic planning and resource allocation.

Frequency of forecasting is a key enabler to stakeholder buy-in

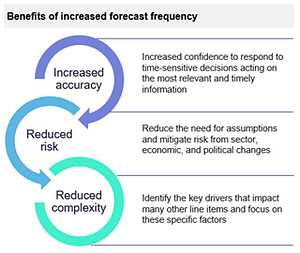

Our study found that those universities which develop more frequent forecasts tend to experience higher levels of engagement with their key stakeholders. While ANZ universities tend to develop similar forecasts informed by student load and known cost drivers, the frequency of the forecasting process (rolling, periodic, event based) varies significantly between participants.

Those universities which deliver forecasts more regularly (i.e. monthly) focus on reducing the amount of detail in each forecast and projecting twelve to eighteen months ahead. In doing so, executives and key decision makers have access to a financial and operational vision of the organisation earlier, which enables a more proactive understanding of problems, challenges and trends. From here, forecasts are regularly shared organisation-wide, providing all units with a sense of the steps they will need to take to meet the strategy’s financial targets. Critically, forecasts are aligned with the same goals and strategies derived from the strategic planning process and annual plan, with an ongoing emphasis on the ‘why’ and ‘what-if’ analysis.

Using story-telling to build engagement

Increasing the transparency and communications across the organisation has helped universities to build stakeholder buy-in. Participant universities have been developing strategies to communicate key concepts and learnings in an accessible, digestible manner. Many have moved to presenting financial performance data to the whole organisation via open ‘town-hall’ style sessions, not just to direct stakeholders. Some institutions are creating ‘narrative-style’ justifications around financial performance and budgetary decision making. Others have adopted the use of simple, consistent analogies, terminology, visuals and designs (i.e. bubble graphs) when communicating abstract or complicated concepts.

By communicating complex concepts and long term performance in a narrative form, budget units are able to articulate a clear purpose, ambition and strategic direction which is connected to the broader university mission and culture. This strategy also helps to demystify budgetary decisions and mitigate any gaps in unit capability and financial acumen by presenting decisions in consistent and ‘lay-person’ language, visuals and imagery.

Making best use of Business Partners

Finally, institutions with successful stakeholder engagement strategies are those which have recognised the importance of business partnership models. Our study found that a lack of financial acumen across key stakeholders in colleges / faculties is consistent across the group, limiting organisational accountability to the budgets and targets. Better utilising the skill and expertise of business partners is a key piece to address knowledge gaps within units and.

While our ANZ universities are utilising business partnership models to varying levels, there were many instances where business partners were under-utilised, viewed as transactional and technical support agents. Framing business partners in this way represents a lost opportunity. This view of business partners often stems from our processes are designed, forcing highly skilled resources into time consuming transactional work. Redesigning processes and leveraging technology can unlock the strategic support value that can be delivered by the Business Partner.

Stakeholder engagement and alignment with strategy is a common challenge. However, we found that implementing the four strategies above can yield meaningful results regardless of the budget model employed by a particular institution. Any budget model, when properly used should be a tool to further strategic ambitions, facilitate good stewardship, and drive institutional accountability. If you’d like to discuss your own challenges or good practice around budgeting and forecasting, or hear more about lessons learned from the global UniForum programme, then please do get in touch via LinkedIn or contacting us by email.

This article was jointly authored by Caitlin Pienaar, Senior Analyst and James Catts, Managing Director – ANZ.